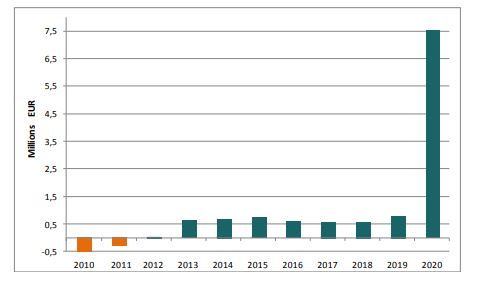

Last year’s balance was exceptionally successful for Centrálny depozitár cenných papierov SR (CDCP SR). Despite the COVID-19 pandemics, CDCP SR achieved profit after tax in amount of 7.52 million euro. The result was accomplished thanks to cancellation of provisions and supporting securities issuing.

The excellent economic result took up again the positive trend of CDCP SR from previous years; results of the company are in positive numbers from the year 2013. „Thanks to this great result we are able to pay out dividends to our shareholder, the Bratislava Stock Exchange“, says Martin Wiedermann, the Managing Director and Chairman of the Board of Directors of CDCP SR. „In addition, the high profit enabled us to set off the remaining losses carried forward, we were battling with for almost entire decade“.

There are several causes of the excellent results. The economic result was markedly influenced by reversed provisions for major legal disputes. But CDCP SR would achieve profit in amount of 2.9 million euro even without this circumstance. The substantial part of last year’s revenues, which contributed to the achieved result, was created by fees for issuance of government bonds by the Debt and Liquidity Management Agency of SR (ARDAL). The government responded to current crisis by issuance of special issues. However, the central depository would show increase in profit by 6.6 percent also after deducting these extraordinary incomes.

Economic results of CDCP SR in years 2010 – 2020 (in mil. EUR):

Last year CDCP SR focused on activities aimed to economy revival, support of interest and issuers’ motivation. „Despite issuance of securities is common for companies in foreign countries, the Slovak companies are lagging markedly“, explains Martin Wiedermann. „Yet the unsure economic situation, caused by the COVID-19 pandemics, requires solutions that are long-term, but fast and simple at the same time. One of the possibilities how companies can attain financial resources to start or revive their business is issuance of bonds“. Issuers’ motivation was the reason why CDCP SR amended its Scale of Fees; prices of selected services were decreased and significant volume discounts were introduced. This was possible thanks to aforesaid higher activity of ARDAL, and of other major Slovak issuers in course of the previous year, in connection with further maximising of costs-efficiency and running digitalisation project.

Cancellation of provisions for legal disputes decided to the benefit of CDCP SR resulted in exceptional decrease of costs by 75%, compared to the year 2019. At the same time, CDCP SR recorded year-to-year growth in revenues by 9%. Total revenues were influenced primarily by revenues from own services, which increased by 7% in the year 2020. Other services that continuously and significantly contribute to total revenues of CDCP SR were also in the previous year represented by the notary services provided to issuers of bookentry securities, administration of security owner accounts and business services for issuers of paper-form securities.

„Future economic result will be influenced by decline in number of owner accounts registered by CDCP SR for natural persons due to exercise of squeeze-out right by majority shareholders of companies listed on the Bratislava Stock Exchange, and because opening of new accounts for natural persons in the central depository was closed. CDCP SR has to cover higher costs related to requirements arising from the European regulation of the central depositories. The result may be positively impacted by continuing digitalisation and implementation of new technologies, e.g. DLT“, clarifies Martin Wiedermann.