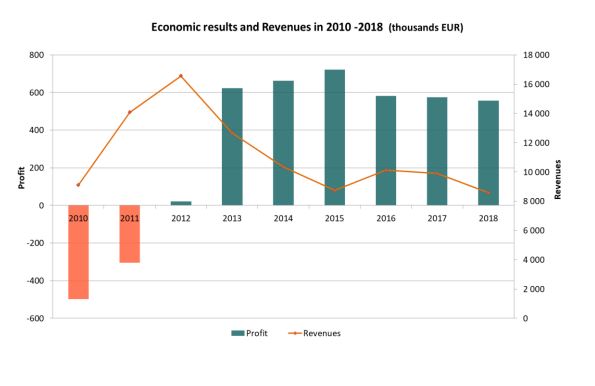

Centrálny depozitár cenných papierov SR, a.s. in the year 2018 followed positive trend of economic results achieved in previous years. Profit of the company in the year 2018 exceeded amount of half a million EUR after taxation.

Positive economic result was achieved despite revenues were 13 % lower than in the year 2017. But yet more sharp downturn was in the costs, which dropped by 14 % compared to the previous year. As a whole, the economic result decreased after taxation by 3%, compared to the previous year. Total revenues of the depository were influenced primarily by sales of own services, which decreased by 10 % in the year 2018 in compared to the previous year. Similarly as in prior years, sales were influenced mainly by revenues from administration of security owner’s account, registration services provided to issuers of book-entry securities, and business services for issuers of paper-form securities, which together created 78 % of total revenues of CDCP.

The central securities depository remains in positive numbers for seventh year already. The Managing Director Martin Wiedermann assesses the year 2018 as very successful. „We have finished successful year as regards results, completed projects, and also due to increasing number of clients to which our central securities depository provides its services.”

In following days the central depository will face several challenges due to development in the area of post-trade services. High level of demand is placed on these services from side of the European institutions so as to provide ever wider scope of services, due to tendency to concentrate certain services to smaller number of entities, or due to growing demands regulating activities of the central securities depositories, issuers and other participants in the capital market. Important factor in this area is application of information technologies trends, as blockchain or artificial intelligence.

The strategy of CDCP for next years is built on the same pillars as in previous period. Within the strategy the central depository has to take in consideration also specificity typical for the local capital market. „We still want to improve quality and extend scope of the services, increase efficiency of provided services and achieve profit despite stagnant capital market“, added Martin Wiedermann.