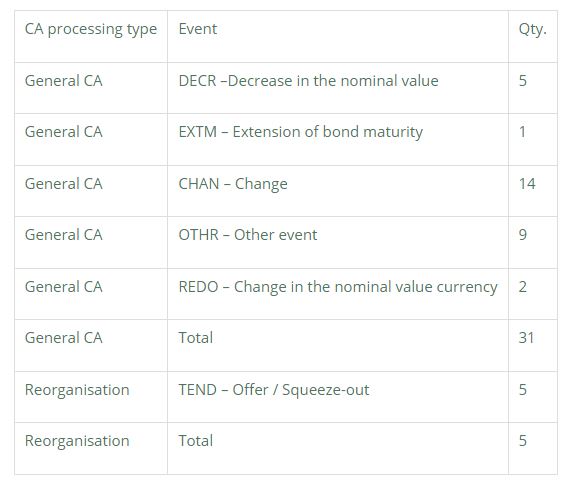

Centrálny depozitár cenných papierov SR, a.s. (CDCP) processed 36 corporate action events in time period from the date when processing of selected types of corporate actions according to market standards were put in operation (30 September 2020) until present days (August 2020).

By the end of the year 2020 CDCP plans to extend the set of corporate actions by other types of reorganisations what would bring a broader information service to the participants.

In September 2020 CDCP put in operation selected messages related to the SRD II Directive. The messages are used for purpose of shareholder identification disclosure and informing on the General Meeting.

In case of disclosure of shareholder identification the issuer with registered office in the EU Member State, the shares of which are admitted to trading on a regulated market situated on or operating within the EU Member State, will be enabled to require CDCP to disclose information on identity of its shareholders with the share on registered capital of the issuer higher than 0.5 %; the request can be placed on specified form. On basis of issuer’s instruction, CDCP shall forward the issuer’s request to other intermediaries (i.e. participants) who records shareholder identification data in their registries to provide them to the issuer. CDCP shall charge 130.00 EUR/ISIN for this service, and the issuer should take in account that the intermediaries may charge their own fees for provision of this service in case the request is forwarded to the intermediaries.

With respect to information on general meeting of an issuer with registered office in the EU Member State, the book-entry shares of which are admitted to trading on regulated market situated on or operating within the EU Member State, based on information from the issuer delivered on specified form, CDCP shall distribute information about the general meeting, respectively the related information for further distribution to shareholders and other intermediaries. CDCP shall not charge the issuer, participants or shareholders for these services.

With the view of aforementioned new services CDCP made changes in the Rules of Operation to govern provision of these services. You can find detailed information on implementation of SRD II in CDCP in dedicated article.

CDCP harmonises also processing of selected types of corporate actions related to debt securities. The harmonisation is component of the “Single Collateral Management Rulebook for Europe – SCoRE“. Harmonisation requirements were identified in the year 2017 by the advisory body of ECB – AMI-SeCo and their implementation to operation is planned on November 2022. Despite this harmonisation activity is independent from other projects of ECB, the implementation deadline was planned in compliance with original introduction deadline for the „Eurosystem Collateral Management System – ECMS“. However, since the Governor Council of the ECB approved postponement of T2/T2S systems consolidation project by one year until November 2022, and postponement of ECMS implementation until November 2023, discussion on possible rescheduling of harmonisation of selected types of corporate actions has been open.

Author: Peter Nagy